CORE Grants Power Meaningful Capital Improvements for Local Businesses

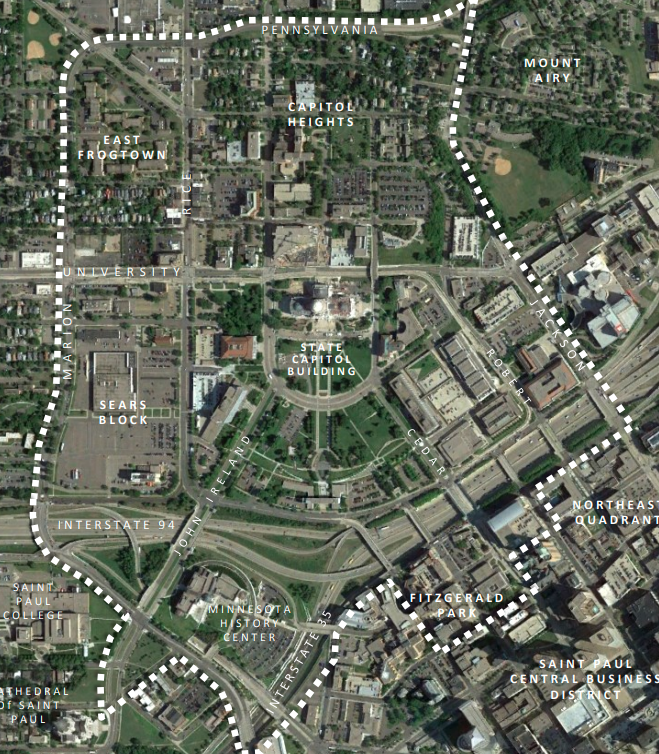

The Saint Paul Port Authority is proud to partner with the State of Minnesota to administer the Capitol Outreach for Revitalization & Expansion (CORE) Grant Program. In the 2025 legislative session, $870,000 was awarded to launch this program focused on revitalizing the Capitol Area by providing grants ranging from $50,000 to $150,000 to local businesses for capital improvement projects.

Who Can Apply?

New, Existing or relocating for-profit business in the Capitol Area are encouraged to apply.

Please Note: Mobile businesses, home-based businesses, nonprofits, schools and government entities are not eligible to apply.

How Can Grant Dollars Be Used?

CORE Grants are for capital improvement projects, such as:

- Facade Improvements

- Energy Upgrade

- New Equipment

- Accessibility Improvements

- Safety Upgrades to the building

Please Note: Capital improvement projects that are already complete are not eligible for the grant program.

When and How to Apply

There are two rounds of grant funding. First-round applicants that were not selected may reapply.

ROUND 1 APPLICATIONS DUE 3/31/26

ROUND 2 APPLICATIONS DUE 8/31/26

What You Need to Apply

- Business and Project Description: Briefly describe your business, the project, and its goals.

- Three Bids: Include at least three vendor bids for proposed work or purchases.

- Project Budget: Provide a detailed budget showing all funding sources and uses.

- Proof of insurance.

- Financial Information

- Established businesses: Submit 3 years of financial statements or tax returns.

- New businesses: Please indicate whether you have a lead bank financing any portion of your business plan or related project costs and include a pro forma with 3-year cash flow projections.

How Will Projects Be Selected?

The applications will be reviewed, scored and awarded by the Saint Paul Port Authority. Grant awards will be reviewed through a point-based, competitive process that prioritizes projects that support employment, tax base expansion, and economic and community vitality.

| Category | What is being evaluated | Weight |

| Employment | Measures on how a project will affect job creation and job quality. | 14% |

| Property Tax or Sales Tax Value | Measures the project’s impact on the property or sales and its potential contribution to local economic development. | 14% |

| Grant Alignment | For new or existing for-profit business making capital improvement in Capitol area supporting economic development. Measuring economic development by jobs, tax base, or sales. | 7% |

| Economic Vitality | Evaluates the financial strength, structure, and sustainability of the business. | 29% |

| Community and Capitol Area Benefit | Measures on how the project contributes to community engagement and enhances the broader capital area. | 22% |

| Inclusion | Measures support for historically underrepresented groups. | 14% |

Other Details:

- Capital improvement projects must comply with prevailing wage and American Disability Act standards, as well as all applicable permitting process and state contractor requirements.

- Grantees will submit reimbursement requests to obtain grant funds. Progress reports will be included with reimbursement requests to track progress and impact.

Application Open January 5, 2026

Additional Resources for your Reference:

- February 5 Recorded Information Session

- February 5 Presentation

- Frequently Asked Questions

- CORE Grant Flyer

- Application Checklist

- CORE Grant Guidelines

- De Subvenciones CORE

Contact Us with Question

651-204-6224

651-204-6216